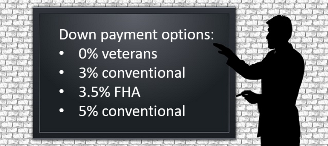

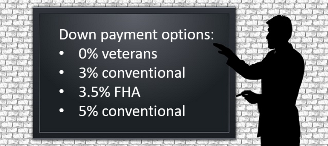

Although the median down payment for a home for first-time home buyers is 6%, many buyers secure mortgages for as low as a 3% down payment, and veterans qualifying for a VA loan can realize a zero down payment.

Although the median down payment for a home for first-time home buyers is 6%, many buyers secure mortgages for as low as a 3% down payment, and veterans qualifying for a VA loan can realize a zero down payment.

So, for a $250,000 home, a buyer could conceivably invest less than $10,000 by having the seller pay for most of the closing costs. Some loan programs even permit the down payment to be a gift from a relative. The approximate monthly payment for a $250,000 home, with a 3% down payment, assuming a 30-year fixed mortgage with a rate at 4%, would be $1,150 per month. Add in taxes and homeowners insurance for the complete payment amount, which will vary per property.

Most would-be home buyers spend a lot of time on line looking at potential homes to buy, but not all of them put themselves in the position to be taken seriously by sellers and lenders.

Most would-be home buyers spend a lot of time on line looking at potential homes to buy, but not all of them put themselves in the position to be taken seriously by sellers and lenders.  Keeping your home safe just takes a little thought and the development of some good maintenance habits. Routine maintenance tasks are very important to ensure the integrity of your home's safety features.

Keeping your home safe just takes a little thought and the development of some good maintenance habits. Routine maintenance tasks are very important to ensure the integrity of your home's safety features.  Did you know that nearly one-third of all homes sold last year were purchased by single persons? Many single women and men are buying homes on their own. In fact, according to the National Association of Realtors® single women accounted for 21% of all home purchases last year, and single men accounted for approximately 10%.

Did you know that nearly one-third of all homes sold last year were purchased by single persons? Many single women and men are buying homes on their own. In fact, according to the National Association of Realtors® single women accounted for 21% of all home purchases last year, and single men accounted for approximately 10%.  Although the median down payment for a home for first-time home buyers is 6%, many buyers secure mortgages for as low as a 3% down payment, and veterans qualifying for a VA loan can realize a zero down payment.

Although the median down payment for a home for first-time home buyers is 6%, many buyers secure mortgages for as low as a 3% down payment, and veterans qualifying for a VA loan can realize a zero down payment.  It's very possible that the best first home for you may be a multi-family home. Having a tenant to help pay your mortgage can really pay off.

It's very possible that the best first home for you may be a multi-family home. Having a tenant to help pay your mortgage can really pay off.